If you’re an OnlyFans creator wondering how taxes work for your income, you’re in the right place. According to doola.com, whenever you earn from OnlyFans, including tips from your followers, you’ll be required to pay income and self-employment taxes because it’s considered a source of self-employment income.

In this article, we’ll provide a step-by-step guide on how to handle taxes and OnlyFans to ensure you don’t run into any tax-related issues.

Check out this Youtube video on how to properly file your taxes as an OnlyFans creator, so you won’t have to stress about paying the IRS and enjoy more time creating content for your social media platform.

Understanding Taxes for OnlyFans Creators

OnlyFans is a popular content-sharing site where creators can post content that is often explicit or sexual in nature for a fee. If you are an OnlyFans creator, it’s important to understand how taxes work so that you can properly file your taxes and avoid any penalties.

- What is OnlyFans?

- Do You Have to Pay OnlyFans Taxes?

- How Do OnlyFans Taxes Work?

OnlyFans is a subscription-based social media platform that allows creators to share various types of content, including adult content, for a fee. Creators can set their own subscription rates, and fans pay a monthly fee to access exclusive content.

Yes, as an OnlyFans creator, you are considered a small business owner and are required to pay self-employment taxes on all the income you earn from the platform. Self-employment tax is generally calculated at a rate of 15.3% and includes both Social Security and Medicare taxes.

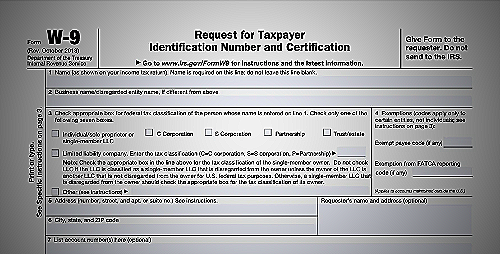

When you earn income from OnlyFans, you are responsible for tracking and reporting that income on your tax return each year. You will receive a 1099 form from OnlyFans that shows your total earnings for the year, which you will use to report your income on your tax return.

It’s important to keep accurate records of all your income and expenses related to your OnlyFans account so that you can properly file your taxes and claim any deductions you’re entitled to.

Additionally, as an OnlyFans creator, you can deduct any expenses related to your OnlyFans account, such as the cost of your camera equipment, props, costumes, and makeup. You can also deduct any internet service fees and website hosting fees associated with your OnlyFans account.

Keep in mind that it’s important to only claim deductions that are legitimate business expenses and to keep accurate records of all your expenses.

Understanding how taxes work as an OnlyFans creator is essential in avoiding any penalties and keeping your finances in order. Make sure to keep accurate records of your income and expenses, and don’t hesitate to seek the advice of a tax professional if you have any questions or concerns.

Filing Taxes for OnlyFans Creators

As an OnlyFans creator, it’s crucial to understand how to file your taxes properly to avoid any issues with the IRS. Firstly, you need to calculate your OnlyFans income for tax purposes.

According to Doola.com, you’re viewed as a small business owner by the IRS, and you’ll be accountable for paying self-employment taxes on your profits at a fixed duty of 15.3%.

To calculate your OnlyFans income, you need to keep track of your earnings from the platform. This includes both your subscription fees and any tips or fees you receive for personalized content requests.

Moreover, you can deduct a majority of the fees associated with your OnlyFans account as business write-offs.

To file your taxes as an OnlyFans creator, you should consider working with a tax professional or using a tax software program. This will ensure that you file your taxes accurately and avoid any potential issues with the IRS.

Lastly, it’s crucial to keep track of your income and expenses as an OnlyFans creator. Make sure to keep all receipts and records of any payments received on the platform.

This will make it easier to file your taxes accurately and avoid any potential issues with the IRS.

Tax Write-Offs for OnlyFans Creators

As an OnlyFans creator, you can take advantage of tax write-offs that may help reduce your tax bill. According to Doola.com, some of the expenses that may be eligible for write-offs include production expenses like cameras, lighting equipment, costumes, and props.

You may also be able to write off home office expenses, fees, and marketing expenses, which can help lower your taxable income. To document your expenses for tax purposes, make sure to keep receipts and records of all your business-related expenses throughout the year.

While it is possible to do your taxes yourself, it may be beneficial to hire a professional to help you navigate the complex tax laws and regulations as an OnlyFans creator. A tax professional can help ensure that you are taking advantage of all available deductions and credits, and can help you avoid costly mistakes that could result in penalties or fines.

Additional Tips for Handling Taxes as an OnlyFans Creator

As an OnlyFans creator, handling taxes can be overwhelming. Here are some tips to help you stay organized and avoid any legal issues:

- Why it’s Important to File Your Taxes on Time: Filing your taxes on time is crucial to avoid penalties and interest charges. As an OnlyFans creator, you are legally required to report and pay taxes on all your earnings. Set a reminder for tax deadlines and make sure to file on time to avoid any issues with the IRS.

- How to Stay Organized Throughout the Year for Tax Season: Keep track of all your earnings and expenses throughout the year. This can be done by using accounting software or even just a simple spreadsheet. Make sure to categorize your expenses and keep all receipts and invoices. This will make tax season a lot easier and less stressful.

- Understanding the Risks of Not Paying Your Taxes: If you fail to pay your taxes, you could face serious consequences such as fines, penalties, and even jail time. The IRS has the power to go after your assets and impose liens and levies. It’s important to understand the risks and consequences of not paying your taxes to avoid any legal issues down the line.

Remember, taxes are an unavoidable part of being an OnlyFans creator. By staying organized and filing on time, you can avoid any legal issues and focus on growing your business.

Conclusion

As an only fans creator, it’s important to understand how taxes work for your income. By following this step-by-step guide and staying organized throughout the year, you can handle taxes and only fans with ease.

References

- Self-Employed Individuals Tax Center

- Frequently Asked Questions on Self-Employment Taxes

- OnlyFans Tax Traps: What Creators Need to Know