As an OnlyFans creator, you must report and pay taxes on your income. The platform will send you a 1099-NEC if you earned more than $600 from the app.

In this article, we will guide you on how to file your OnlyFans tax form online.

If you’re an OnlyFans content creator, it’s important to know how to file your taxes correctly to avoid any legal issues. The good news is that you can easily file your OnlyFans tax form online.

If you earn more than $600 from the platform, OnlyFans will send you a 1099-NEC form, which you should include in your tax filing. By filing online, you can quickly and easily enter your information and submit your taxes.

Just make sure to keep accurate records of your income and expenses throughout the year to make the process smoother. In the next sections, we’ll guide you on how to file your OnlyFans tax form online properly.

Check out this Youtube video: “I Make Money From OnlyFans – How Do I File My Taxes?!” To learn how to properly handle your taxes for your income on the popular social media platform and avoid any potential legal issues.

Understanding OnlyFans Taxes

Do I have to pay taxes on my OnlyFan income?

Yes, you have to pay taxes on your OnlyFans income. Even if you only earned a small amount from the app, you still need to report it on your tax return.

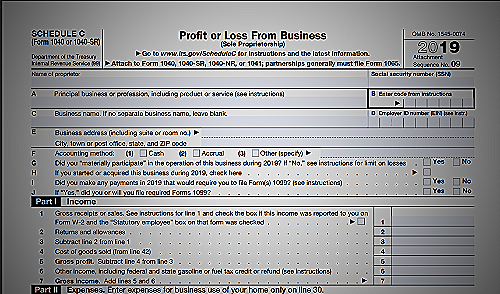

The IRS considers OnlyFans income as self-employment income, which means you have to file a Schedule C form and report it on your Form 1040 tax return. Moreover, you may need to make estimated tax payments throughout the year if you expect to owe at least $1,000 in taxes.

To make tax season easier, OnlyFans provides tax information to their creators. They send out 1099 forms to creators who earned more than $600 in a year.

Creators can find their tax form online on the OnlyFans website. The form will detail your total earnings and any other relevant financial information.

It is essential to keep accurate records of your OnlyFans income and related expenses to ensure accurate reporting and avoid potential tax penalties. Consulting a tax professional can also provide valuable guidance for managing your OnlyFans income taxes.

What can I deduct as an OnlyFans creator?

As an OnlyFans creator, you can claim several deductions to lower your tax bill. Some of the expenses that you can deduct include computer and internet expenses, camera and lighting equipment, costumes and props, professional subscriptions and memberships, and travel expenses for shoots outside your home.

Keep in mind that you must ensure that these expenses are directly related to your OnlyFans activities and are not personal expenses. It is recommended to consult with a tax professional to ensure that you are claiming the correct deductions on your OnlyFans tax form online.

What you can’t deduct from your OnlyFans income

As an OnlyFans content creator, there are expenses that you can deduct from your income, but there are also expenses that you cannot deduct. Here are some of the things that you cannot deduct from your OnlyFans income:

- Personal expenses that are not related to your OnlyFans business, such as groceries or rent

- Illegal or unethical expenses, such as payments for illegal services

It’s important to keep track of your expenses and make sure that they are related to your OnlyFans business in order to properly file your taxes.

If you are unsure about what expenses you can deduct from your OnlyFans income, it’s best to consult with a tax professional or use tax software to ensure that you are accurately filing your taxes.

Gather your tax information

To file your OnlyFans tax form online, you first need to gather all relevant tax information. This includes your 1099-NEC form provided by OnlyFans, as well as any other forms or receipts related to your business on the platform.

It’s important to collect this information early to ensure you have everything ready to file your taxes on time. Remember that you are responsible for accurately reporting all earnings from your OnlyFans account and paying the appropriate taxes on it.

Choose a tax preparation software

When filing your taxes as an OnlyFans content creator, it’s important to choose a tax preparation software that can handle the forms you need to file. Many popular tax software options, such as TurboTax and H&R Block, can help you file your taxes as an independent contractor.

These programs typically include tools and forms for reporting income and expenses, as well as deductions for things like home office expenses and business-use vehicles. Be sure to choose a software that is compatible with all the tax forms you need to file, including any specific forms required for reporting your OnlyFans earnings.

Enter your OnlyFans income and expenses

As an OnlyFans content creator, it is important to keep track of your income and expenses for tax purposes. To start, enter all of your OnlyFans income and deductions into your tax preparation software or hire a tax professional to do it for you.

Make sure to input the correct information to avoid any errors on your tax return. It is also recommended to keep all receipts and documents related to your OnlyFans business expenses, such as equipment, internet and phone bills, and advertising costs.

By keeping accurate records of your income and expenses, you can ensure that you are not overpaying or underpaying your taxes.

File electronically

When it comes to filing taxes for OnlyFans creators, it is important to file electronically. This can be done through tax preparation software such as TurboTax or H&R Block.

By filing electronically, you can ensure that your tax return is accurately and efficiently processed. Additionally, filing electronically can also ensure that you receive any potential tax refunds quicker.

It is important to have all of your tax information, including any income earned from OnlyFans, before filing electronically.

FlyFin: The OnlyFans Tax Tool

Automated Tax Deductions

FlyFin is a financial management software that automatically tracks your income and expenses from OnlyFans and calculates your estimated taxes owed. This feature is beneficial for OnlyFans content creators as it alleviates the hassle of manually tracking earnings and filing taxes.

With FlyFin, OnlyFans users can effortlessly monitor their finances and ensure that they are compliant with tax laws. Sign up for FlyFin’s automated tax deduction services today to streamline your OnlyFans revenue tracking and taxation process.

CPA Assistance

If you need professional help in filing your taxes for your OnlyFans earnings, FlyFin offers the assistance of certified public accountants (CPA) for an additional fee. These experts specialize in navigating the complexities of tax laws and can provide guidance on tax deductions and credits that can help minimize your tax liability.

With their help, you can ensure that your taxes are filed correctly and avoid costly mistakes that can lead to penalties and interests. Contact FlyFin for more information on their CPA assistance services.

Conclusion

Filing your OnlyFans tax form online can be easy and stress-free by following the steps outlined above or using tools like FlyFin. Make sure that you report all of your income and claim eligible deductions to ensure that you are paying the accurate amount of taxes.