If you’re earning money from OnlyFans, it’s important to know that you’ll need to pay taxes on that income. According to Doola, including tips, any income that you derive from OnlyFans is subjected to the same taxation processes as a regular job.

This means that you’ll need to pay self-employment and income taxes on these earnings. As this may confuse some people, in this article we’re going to cover everything you need to know about paying OnlyFans taxes.

Based on the search results from Doola, all earnings that are obtained from OnlyFans, including tips, are categorized as self-employment income. This means that it is money earned through labor that does not fall under wage payment, and as a result, must be taxed as such.

Individuals who earn money from OnlyFans must pay self-employment and income taxes on their earnings. Therefore, it is essential to understand how to handle taxes related to OnlyFans, which we will cover in this article.

Check out this Youtube video: “How I File My ONLYFANS TAXES!” For tips on how to properly pay taxes on your social media income.

Understanding OnlyFans and Taxes

What is OnlyFans?

OnlyFans is a social media platform that allows creators to monetize their content by charging fans a subscription fee. Creators can also earn tips and receive requests for custom content, which can increase their earnings.

OnlyFans is mostly known for adult content, but it can also be used for other types of content, such as fitness, music, and more.

What tax obligations come with using OnlyFans?

If you earn income through OnlyFans, it is important to be aware of the tax obligations that come with it. The money earned from OnlyFans is categorized as self-employment income, similar to what freelancers or sole proprietors earn.

Therefore, you are required to pay income tax and self-employment tax on the earnings you receive from OnlyFans. It is recommended to keep track of your earnings and expenses, as well as seeking advice from a tax professional to ensure compliance with tax laws.

Do You Have To Pay OnlyFans Taxes?

Yes, any income you earn from OnlyFans is subject to taxation in the same way as a traditional job. This means you’ll need to pay income and self-employment taxes on your earnings.

It’s essential to know your tax obligations to avoid penalties and interest on unpaid taxes.

How Does OnlyFans Tax Work?

As an OnlyFans creator, you will be considered a small business owner by the IRS. It is your responsibility to report your income accurately on your tax return and pay the right amount of taxes.

This means you will be responsible for paying self-employment taxes at a flat rate of 15.3% on your earned income. However, you can offset some of these taxes by deducting various business expenses related to your OnlyFans account.

Deductions for expenses like equipment, internet, and marketing can help reduce your tax liability and keep more of your hard-earned money in your pocket. Consider using bookkeeping software or a spreadsheet to keep track of your income and expenses for easier tax filing.

How To Pay Taxes on OnlyFans

Determine Your Tax Filing Status

When filing your taxes as an OnlyFans content creator, it is important to determine your tax filing status. This status will determine your tax bracket and the amount of taxes you owe.

If you are single, you will likely file as a single filer. If you are married, you can file jointly with your spouse, and if you are unmarried with dependents, you may qualify for head of household.

It is important to consult a tax professional to ensure that you are filing correctly and taking advantage of all eligible deductions and credits.

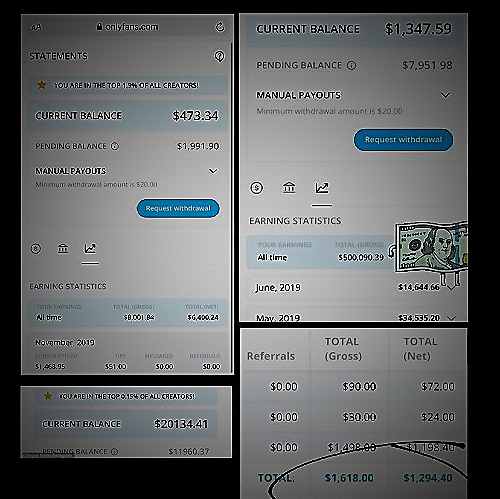

Calculate Your Net Income from OnlyFans

To calculate your net income from OnlyFans, you need to deduct your qualifying business expenses from your gross income. Your gross income includes all the money you received from your OnlyFans account.

Your qualifying expenses may include content creation costs, equipment, internet services, marketing, and other related expenses. Once you subtract these expenses from your gross income, you will get your net income.

This net income will be the basis for calculating your taxes. Use an online calculator or consult your accountant for assistance in computing your net income and taxes.

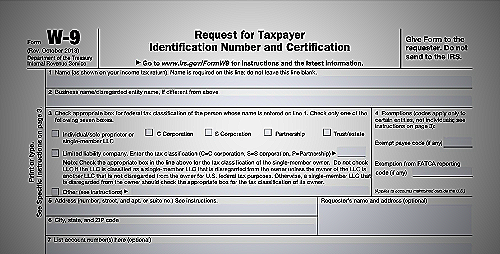

Fill Out Tax Forms

If you’re earning from OnlyFans, you need to report it on your tax forms. You need to categorize it as “other income” on your 1040 form.

However, if you consider your OnlyFans account as a business, you have the option to disclose it on a Schedule C form. As a self-employed individual, you’ll also need to fill out Schedule SE to calculate self-employment tax and report your OnlyFans income and expenses on Schedule C. Make sure to accurately report your income to avoid any legal or financial issues down the line.

Pay Your Taxes

When it comes to paying taxes for your OnlyFans income, it’s important to calculate your net earnings by deducting eligible business expenses from your overall income. Once you have determined your net earnings, you can input this amount on the required form and receive an estimate of your self-employment tax.

Consider using electronic payment methods such as online payment or direct debit to ensure timely and accurate payment.

As a self-employed individual, it’s important to stay organized and keep track of all your business expenses to reduce your taxable income. Some common eligible business expenses for OnlyFans creators include equipment costs, internet bills, marketing expenses, and any necessary subscriptions or software.

When in doubt, consult a tax professional to ensure you are accurately reporting your income and paying the correct amount of taxes.

OnlyFans Tax Write Off

Home Office Expenses

If you use a portion of your home as your workspace for OnlyFans, you can deduct a portion of your rent, mortgage interest, property taxes, utilities, and other expenses that you incur for that space. This is because home office expenses are considered tax-deductible if the space is used exclusively for business purposes.

Keep track of your expenses and consult with a tax professional to ensure you are taking advantage of all the deductions available to you. Remember that claiming false or inflated deductions can lead to penalties and legal issues.

Equipment and Supplies

Being an OnlyFans content creator means buying equipment and supplies, such as cameras, lighting, computers, editing software, lingerie, makeup, and more. The good news is, you can deduct the cost of these items as a business write-off on your tax return.

By doing this, you can significantly reduce the amount you owe in self-employment and income taxes, and save money in the process.

Marketing and Advertising

According to Doola, as an OnlyFans content creator, you can deduct the cost of marketing and advertising your account as a business cost on your tax return. These deductions can include expenses such as social media ads or paid promotions.

In order to take advantage of these deductions, it is important to keep detailed and organized records of these expenses.

Professional Services

According to Doola.com, OnlyFans creators can deduct expenses related to their account as business write-offs. This means that expenses incurred can be subtracted from overall income on tax returns, ultimately reducing self-employment and income taxes and earning more profits.

Hiring professional services such as accountants, tax preparers, and lawyers can also be deductible expenses, making it easier to manage OnlyFans taxes and business operations.

Hire A Professional To Save the Most From Your OnlyFans Taxes

If you want to ensure that you’re getting the most savings from your OnlyFans taxes, hiring a professional is a great option. Not only can they help reduce your tax burden and find deductions you may have missed, but they can also provide guidance on proper tax filing and record-keeping.

With careful management of business expenses, you can optimize your financial situation and save on taxes come tax time. Don’t miss out on this opportunity—consider working with a qualified tax professional today.

Conclusion

Paying taxes on your only fans income may seem confusing and daunting, but it’s essential to do it right to avoid penalties and interest. Understanding your tax obligations, keeping accurate records of your income and expenses, and taking advantage of tax deductions are crucial steps to paying your only fans taxes successfully.

Consider seeking professional tax advice if you need additional guidance or have a complex tax situation.