Are you an OnlyFans creator wondering how to put OnlyFans on taxes? Look no further than this guide which will walk you through everything you need to know about handling your income and taxes.

According to Doola.com, you need to declare your earnings made on OnlyFans as “other income” on your 1040 form. However, if you’re treating your OnlyFans account as a legitimate business, then you can report it on a Schedule C form.

This guide will cover the basic steps you need to take to put OnlyFans on taxes properly.

Are you an OnlyFans creator looking for guidance on tax filings? Check out this Youtube video to learn how to put OnlyFans on taxes and stay on top of your finances!

Understanding OnlyFans Taxes

As a creator on OnlyFans, it is important to understand your tax obligations. According to www.doola.com, all the money earned on OnlyFans, including tips, is subject to taxation rules just like any other job.

This is because OnlyFans income is classified as self-employment, where earnings are based on your work rather than a fixed salary.

As a result, creators on OnlyFans must pay income and self-employment taxes on their earnings. It is important to consult with a tax professional or research the specific tax regulations in your country or state to ensure compliance with the law.

Failure to pay taxes on OnlyFans income can result in penalties and legal consequences. It is crucial to keep accurate records of all earnings and expenses related to your OnlyFans account to ensure proper tax reporting and payment.

What Can You Deduct on Your OnlyFans Taxes?

If you are a creator on OnlyFans, there are expenses that you can deduct from your income to minimize your tax liabilities. According to Silvertaxgroup.com, necessary expenses associated with running your OnlyFans page such as pens, printer paper, and toner can be deducted.

Moreover, you can also deduct a portion of your internet service provider fee dedicated to your OnlyFans work. Cell phone expenses used for business purposes can also be deducted, so make sure to keep accurate records of all business-related expenses throughout the year to maximize your tax savings.

It is important to take note that there are deductions that are not allowed for OnlyFans creators. Personal expenses such as clothes, gym membership, and personal grooming cannot be deducted.

Additionally, deductions for meals and entertainment expenses are limited.

How to Properly Pay Your OnlyFans Taxes

If you are an OnlyFans content creator, it is crucial to report your income according to the IRS guidelines to avoid any legal or financial consequences. Here’s what you need to keep in mind:

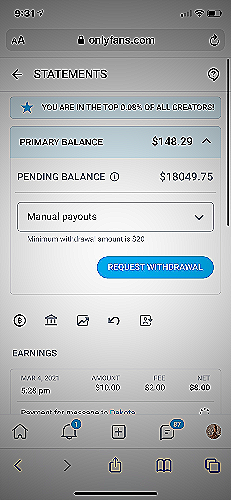

- Tracking your income: It is essential to keep accurate records of your earnings, including tips and any other payments received from your subscribers. You can use accounting software or a spreadsheet to track your income and expenses throughout the year.

- When are your OnlyFans taxes due?: If you are operating as a sole proprietor, your tax return and payment are due on April 15th. However, if you are operating a legitimate business, the deadline may vary, depending on the type of business entity you have registered.

- How to calculate your OnlyFans taxes: You can calculate your tax liability by deducting business expenses from your income. It is recommended to consult with a tax professional to make sure you are claiming all your business expenses legally.

- How to pay your OnlyFans taxes: You can make your tax payment online or through mail by following the instructions on the IRS website. It is essential to keep track of any penalties and interest charges applied to your account and make timely payments to avoid further consequences.

- What happens if you don’t pay your OnlyFans taxes?: If you fail to pay your OnlyFans taxes, the IRS can charge interest and penalties on your outstanding balance. If your account is not resolved, the IRS can take enforcement actions, such as wage garnishments or levies on your assets.

Remember, it is essential to report all of your OnlyFans income and pay your taxes promptly to avoid any legal or financial issues. Consult with a tax professional to ensure you are complying with all legal obligations.

How to File Your OnlyFans Taxes

To file your OnlyFans taxes, you need to decide how to file. According to Doola, you’ll need to include your earnings from OnlyFans in your income tax filing under “other income” in your 1040 form.

You should also consider reporting it on your Schedule C form if you’re running your OnlyFans account like a real business.

You can either file using Form 1040 or Schedule C. Form 1040 is for reporting your personal income, including “other income.” Schedule C is used for reporting income and expenses from a sole proprietorship, which would be appropriate if you are running your OnlyFans account as a business.

You should file your OnlyFans taxes as soon as possible to avoid any penalties or interest. The deadline for filing your taxes is usually April 15th, but it may vary depending on the year and your location.

Check with the IRS for specific deadlines.

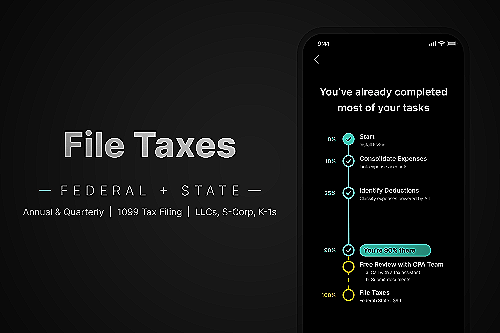

To file your OnlyFans taxes, you can use tax software or hire a tax professional. Tax software can guide you through the process step-by-step, or you can hire a tax professional to file on your behalf.

Ensure that you have accurate income figures and expense records for your OnlyFans account before filing.

Remember, it’s important to file your taxes correctly to avoid any issues with the IRS. Be sure to report your OnlyFans earnings and expenses accurately and seek professional help if needed.

What is FlyFin?

FlyFin is a financial platform that helps OnlyFans creators with their taxes and finances. They offer automated tax deductions and CPA assistance to ensure OnlyFans creators are compliant with their tax obligations.

According to FlyFin’s website, it is important for content creators to file Schedule C on their 1040 Form as a sole proprietor to report their revenues and expenses. FlyFin may be helpful for OnlyFans creators looking to properly manage and file their taxes.

Conclusion

Putting OnlyFans on taxes can seem intimidating, but with the right information and organization, it’s a simple process. Remember to keep track of your income and expenses and report them accurately on your tax returns.

Hiring a tax professional can also be helpful in ensuring you comply with all tax laws.