As an OnlyFans creator, having a plan for properly managing your income for taxes is crucial. One of the documents you need for this purpose is your 1099 form, which reports your earnings to the IRS.

But what if you didn’t receive your 1099 from OnlyFans? According to Hellobonsai.com, you should first update your mailing address on OnlyFans because it’s possible the form was sent to the wrong address.

If you still don’t receive the 1099-NEC tax form even though you meet the requirements, don’t worry. Logging into your OnlyFans account makes it easy to access and download the form.

In this article, we will explain how to get your 1099 from OnlyFans using the focused keyword “how to get my 1099 from OnlyFans.

Check out this Youtube video for a step-by-step guide on how to get your 1099 form from Onlyfans and ensure you’re paying your taxes correctly.

Check Your Mailbox

If you’re wondering how to get your 1099 from OnlyFans, the first thing you should do is check your mailbox. OnlyFans will send the form via mail to the address you provided in your account.

If you haven’t received it yet, don’t worry. OnlyFans sends these forms out through January, so it might just take some time to arrive.

Make sure that the address on your account is correct and up-to-date to ensure you receive the form without any issues. If you have moved or need to update your address, do so as soon as possible by contacting OnlyFans support.

Verify Your Address in OnlyFans

To ensure that you will receive your 1099 form from OnlyFans, it is important to verify that your mailing address in your account is correct. Log in to your OnlyFans account, and check if your mailing address is accurate.

If it is incorrect, update it right away. According to hellobonsai.com, you can easily download the form directly from your OnlyFans account once you qualify for a 1099-NEC.

Don’t miss out on receiving this important tax document. Double-check your address to avoid any issues when tax season comes.

Download Your 1099 From OnlyFans

If you haven’t received your 1099 form from OnlyFans, don’t worry. You can still download it directly from your OnlyFans account.

To do this, simply log in to your account, click on the “Earnings” tab, and scroll down to the “Tax Forms” section. From there, you can easily download your 1099 form by clicking the “Download” button next to it.

Keep in mind that you need to meet the eligibility criteria to download your 1099 form. If you’re having trouble receiving your 1099 form via mail, be sure to double-check your account address to ensure it’s accurate.

OnlyFans may sometimes send the form to the wrong address, but you can still obtain your form by following the steps above.

Contact OnlyFans Support

If you’re having trouble getting your 1099 form from OnlyFans, your best bet may be to reach out to customer support. They’ll be able to help you troubleshoot the issue and ensure that you receive all the necessary tax documentation.

You can contact OnlyFans support through their website, either by logging into your account and submitting a support ticket or by emailing them directly at [email protected]. Make sure to provide any necessary information, such as your account details, to help expedite the process.

Organize Your Income and Expenses

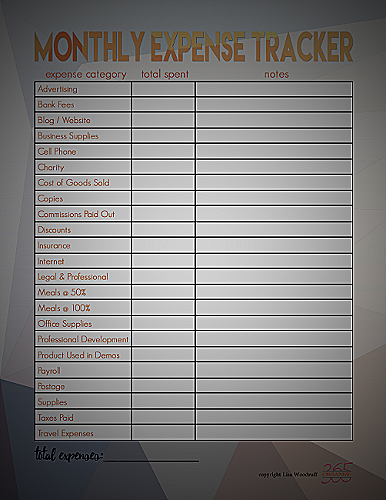

If you’re an OnlyFans creator, you’ll need to keep track of your earnings and expenses for tax purposes. Once you get your 1099 form, use a spreadsheet or tax software to record all your income and expenses related to your OnlyFans income.

This includes your earnings from content sales, tips, and any fees or commissions paid to OnlyFans. Remember to also deduct any business expenses, such as camera equipment, lighting, and other materials.

Organizing these records will make it easier to file and pay your taxes accurately and on time.

Conclusion

Retrieving your only fans 1099 form doesn’t have to be a hassle. By checking your mailbox and only fans account, downloading the form, and contacting support if needed, you can easily get your hands on this document.

Don’t forget to properly organize your income and expenses to make tax season a breeze.

References

If you have not yet received your 1099 form from OnlyFans, you can check your account to see if it is available for download. According to Bonsai, if you have met the requirements for a 1099-NEC but have not received it in the mail, you should double-check your address on your OnlyFans account. You can also access and download the form from your OnlyFans account if it is available.