As an only fans creator, you might wonder how to fill out the W2 form correctly to avoid legal issues and hefty fines in the future. In this article, we will walk you through the steps to fill out your only fans W2 and provide tax tips for 2023.

When it comes to filling out your only fans W2 form, it is crucial to understand the process to avoid any mistakes that could lead to legal issues in the future. According to the irs, you are required to report all income earned, and as an only fans creator, your earnings are taxable income.

Here are some tips to help you fill out your form correctly:

How to Fill Out Your only fans W2

The only fans W2 form is a document that shows your earned income and taxes paid within the year. To fill out the form, you’ll need to follow these steps:

- Start by in putting your personal information, which includes your name, address, and social security number. Make sure you double-check this information for accuracy.

- Locate your earnings statement on only fans, which will show your income earned for the year. This statement should indicate your gross earnings, net earnings, and any taxes withheld by OnlyFans.

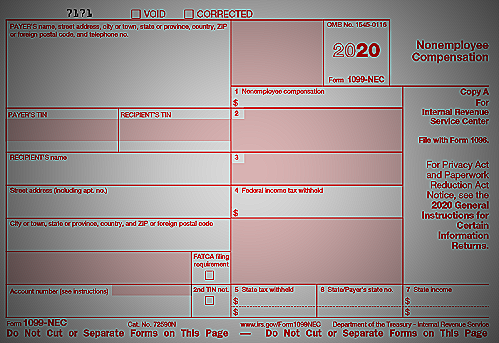

- Report these earnings on your W2 form under the appropriate boxes. Gross income would be reported in box 1, while net earnings would be reported in box 3. Taxes withheld by only fans would be reported in box 2.

- If you’ve received any non-employee compensation that’s not included in your only fans earnings statement, report this income in box 7.

- Calculate any additional taxes you may owe, such as self-employment tax, and report this in box 4.

- Once you’ve filled out all the necessary information, double-check everything for accuracy before submitting your only fans W2 form.

It’s crucial to remember that failure to report all income earned can lead to legal troubles in the future. Make sure to keep accurate records of your earnings to avoid any issues with the irs.

Pay

When it comes to paying taxes as an only fans creator, it’s essential to understand that you’re considered self-employed and responsible for paying self-employment taxes. This means you’llneed to pay both the employer and employee portions of social security and Medicare taxes.

The current self-employment tax rate is 15.3, which includes 12.4% for social security taxes and 2.9% for Medicare taxes.

To calculate your self-employment tax, you’ll need to use Form 1040 and Schedule se. You can find these forms on the irs website or through tax software programs.

Remember to keep accurate records of your earnings and expenses, as these will be used to determine your tax liability.

Social Media

As an only fans creator, it’s essential to utilize social media to promote your content. However, it’s important to remember that any income earned through social media platforms must be reported on your tax returns.

This includes any earnings from sponsored posts, affiliate marketing, or other partnerships.

Make sure to keep accurate records of your social media earnings and expenses, as these will be used to determine your tax liability. Consider working with a tax professional who can help you understand your tax obligations and ensure you’re filling out your only fans W2 form and other tax documents correctly.

In Conclusion, filling out your only fans W2 form accurately is crucial to avoid any legal issues in the future. It’s essential to understand your tax obligations as an only fans creator and keep accurate records of your earnings and expenses.

When in doubt, consider contacting a tax professional who can help guide you through the process and ensure you’re following all the necessary tax rules and regulations. By following the tips outlined in this article, you can feel confident in filling out your only fans W2 form and remaining compliant with tax laws.

Understanding OnlyFans Tax Obligations

OnlyFans requires creators to report their income to the Internal Revenue Service (IRS) through Form 1099-NEC. Those who earn more than $600 annually must fill out the W2 form.

Here’s how:

- Provide either your Social Security Number or your Employer Identification Number (EIN) in the designated box.

- Enter your legal name and address into the form.

- Input your earnings from your OnlyFans account into the required boxes.

- Include any extra information such as expenses that you want to consider when filing taxes.

It’s crucial to correctly fill out the W2 form to avoid any tax issues with the IRS. Refer to the image below for the W2 form and fill it out accordingly.

Tax Tips for 2023

Keep Accurate Records

Keeping accurate records is crucial when it comes to filing your taxes, especially if you earn income from OnlyFans. This means you need to keep track of all the money you receive from OnlyFans and any expenses associated with it.

You should be able to document how much you earned and how much you spent. Keeping receipts, invoices and other documentation for expenses is a must.

You should also regularly track your bank statements and other financial statements to ensure your records are up-to-date and accurate. By keeping accurate records, you will avoid any issues when it comes to filling out your OnlyFans W-2 form.

Estimate Your Tax Liability

When it comes to taxes, it’s important to estimate your tax liability to avoid any surprises when it’s time to file your tax return. To estimate your tax liability, you will need to have an understanding of your income, expenses, and deductions.

For OnlyFans creators, filling out the W2 form can be a bit confusing. It’s important to remember that taxes will need to be paid on any income earned from OnlyFans.

To estimate your tax liability, you can use a tax calculator or consult with a tax professional.

One important factor to keep in mind is that OnlyFans does not withhold taxes from your income, so it’s up to you to set aside a portion of your earnings to cover your tax liability. Failure to do so can result in penalties and interest charges.

To avoid any surprises, it’s recommended that you estimate your tax liability each quarter and make estimated tax payments if necessary. This will help ensure that you are staying on top of your tax obligations and avoiding any penalties or interest charges.

Consider Hiring a Professional

If you’re unsure of how to properly fill out your OnlyFans W2 and have concerns about tax obligations, it may be in your best interest to hire a certified public accountant or tax professional. These professionals are well-versed in tax laws and can assist you in accurately filling out your W2 form and ensuring that you meet all tax obligations.

While this may result in additional costs, it can save you time, money, and the risk of potential penalties in the long run. Consider reaching out to a professional if you have any doubts or questions about the tax filing process.

Conclusion

Filling out your only fans W2 form may seem daunting, but with proper guidance and preparation, it can be a smooth process. Accurately reporting your income and expenses, as well as seeking professional advice if necessary, are key steps to ensure tax compliance.