Are you a content creator on OnlyFans and need to file a W9 form? Filling out this form may seem daunting, but with this guide, you’ll be able to do it in minutes.

In this article, we’ll provide you with a step-by-step process on how to fill out a W9 for OnlyFans.

When it comes to filling out a W9 for OnlyFans, it’s important to have all the necessary information on hand. This includes your legal name, social security number or taxpayer identification number, and address.

According to OnlyFans support, you can find your TIN on any tax documents from the government or on your pay stub if you’re employed. If you don’t have a TIN, you can apply for one through the IRS website.

Once you have all the required information, you can follow these steps to fill out your W9 form with ease.

Check out this Youtube video to learn how to properly fill out a W-9 form for your OnlyFans account and make sure you get paid correctly!

Understanding the W9 Form for OnlyFans

If you’re new to OnlyFans, you’ll need to know how to fill out a W9 form to ensure you’re paid correctly for your content. Here’s what you need to understand.

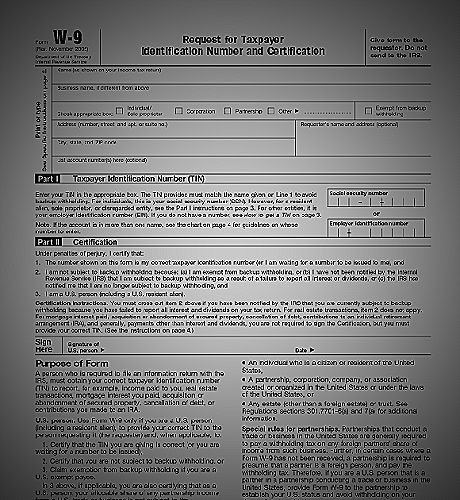

- What is a W9 form? A W9 form is a tax form used to gather information from independent contractors or freelancers. It’s used to report income paid to the IRS.

- Where can I find the W9 form? You can download the W9 form from the IRS’s website or from OnlyFans’ platform.

- Do I need to fill out a W9 form for OnlyFans? Yes, if you’re earning money through OnlyFans, you’ll need to fill out a W9 form to ensure you’re paid correctly and to comply with tax laws.

- How do I fill out the W9 form for OnlyFans? You’ll need to provide your name, tax ID number, and address. OnlyFans provides a step-by-step guide on how to fill out the W9 form on their platform, and you can find more information on the IRS website.

- What if I don’t fill out the W9 form for OnlyFans? If you don’t fill out the W9 form, OnlyFans may not be able to pay you for your content and you may face tax penalties.

Make sure to take the time to fill out your W9 form correctly to ensure you’re paid correctly for your content on OnlyFans.

Steps to Fill Out the W9 Form for OnlyFans

To begin filling out your W9 form for OnlyFans, follow these simple steps:

Step 1: Download and Print the W9 Form

You can find the W9 form on the IRS website. Download and print a copy of the form so you can fill it out manually.

Step 2: Fill in Your Name and Address

Enter your full legal name in Box 1 on the W9 form. If you have a business name, enter it in Box 2. In Box 3, provide your mailing address.

Step 3: Provide Your Taxpayer Identification Number

In Box 5, provide your Social Security Number (SSN) or your Individual Taxpayer Identification Number (ITIN). If you don’t have an SSN or ITIN, you can apply for an ITIN by filling out Form W7.

Step 4: Sign and Date the Form

You should sign and date the W9 form in Box 3 to certify that the information provided is accurate.

By following these simple steps, you can easily fill out the W9 form for OnlyFans and ensure that all necessary information is provided. Remember to double-check all information before signing and submitting the form.

Frequently Asked Questions

Do I need to fill out a new W9 form every year for OnlyFans?

Will OnlyFans withhold taxes?

Conclusion

- Firstly, log into your only fans account and navigate to the Tax Information section.

- Fill out the W9 form accurately with the information that is required.

- Make sure that you have entered your name and address exactly how it appears on your tax return.

- Provide your social security number or employer identification number.

- If applicable, select your tax classification based on your business type (individual or non-individual).

- Once you have completed the W9 form, submit it for only fans to review and process.

References

- [alink href=’aHR0cHM6Ly9ibG9nLmUtZmlsZS5jb20vdzktZm9ybS0xMDEtdW5kZXJzdGFuZGluZy10aGUtcHVycG9zZS1vZi10aGUtdzktZm9ybS8=’ text=’VzkgRm9ybSAxMDE6IFVuZGVyc3RhbmRpbmcgdGhlIFB1cnBvc2Ugb2YgdGhlIFc5IEZvcm0=’]

- [alink href=’aHR0cHM6Ly93d3cuZnVuZGVyYS5jb20vYmxvZy9ob3ctdG8tZmlsbC1vdXQtdzk=’ text=’SG93IHRvIEZpbGwgT3V0IGEgVy05IEZvcm06IEEgU3RlcC1ieS1TdGVwIEd1aWRl’]

- [alink href=’aHR0cHM6Ly9hZHVsdHZlcmlmaWVkdmlkZW9jaGF0LmNvbS9ibG9nL2hvdy10by1maWxsLW91dC1hLXc5Lw==’ text=’SG93IHRvIEZpbGwgT3V0IGEgVzkgZm9yIFBlcmZvcm1lcnMgYW5kIENvbnRlbnQgQ3JlYXRvcnM=’]