If you’re earning money through your OnlyFans account, it’s important to know how to file taxes for OnlyFans. According to Doola, you will need to report the money you make as “other income” on your 1040 form.

However, if you’re treating your OnlyFans account like a real business, then you can report it on a Schedule C form. In this guide, we’ll go over the basics of OnlyFans taxes and provide a step-by-step guide on how to file taxes for OnlyFans.

If you’re making money on OnlyFans but are unsure about how to file your taxes, check out this helpful Youtube video titled “I Make Money From OnlyFans – How Do I File My Taxes?!”

Do I Have to Pay Taxes on My OnlyFans Income?

Yes, you are required to pay taxes on any income earned from OnlyFans according to Doola. You need to report the money you make as “other income” on your 1040 form.

However, if you are treating your OnlyFans account as a real business, then you can report it on a Schedule C form.

How Do My OnlyFans Taxes Work?

According to Doola.com, as an OnlyFans creator, you’re considered a small business owner by the Internal Revenue Service (IRS). You are required to report the money you make as “other income” on your 1040 form.

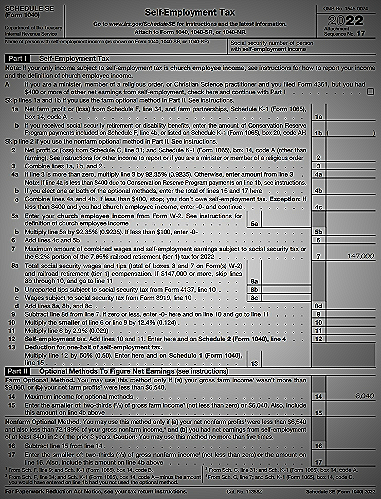

However, if you treat your OnlyFans account like a real business, you can report it on a Schedule C form. You’ll have to pay self-employment taxes on your income, which are at a flat rate of 15.3%.

The good news is that you can deduct many of the expenses related to your OnlyFans account as business write-offs.

What Can I Deduct as an OnlyFans Creator?

As an OnlyFans creator, you are considered a small business owner, and you will need to report the money you make as “other income” on your 1040 form. But if you are treating your OnlyFans account like a real business, then you can report it on a Schedule C form.

According to doola.com, many of the expenses related to your OnlyFans account can be deducted as business write-offs. You can deduct any expenses related to your OnlyFans business, such as camera equipment, internet bills, and advertising costs.

Any expenses incurred in running your OnlyFans page, such as pens, printer paper, and toner, are tax-deductible. You can also deduct the costs of your internet service provider that are used for your OnlyFans business.

The percentage of cell phone expenses used for OnlyFans business is also tax-deductible.

What You Can’t Deduct from Your OnlyFans Income

According to the Doola blog, personal expenses such as clothing or makeup cannot be deducted from your OnlyFans income. However, if you treat your OnlyFans account as a real business, many expenses related to your account can be tax-deductible.

IRS considers OnlyFans creators as small business owners and self-employment taxes apply on their income at a flat rate of 15.3%. You will need to report the money you made as “other income” on your 1040 form.

Furthermore, expenses incurred in running your OnlyFans page, such as pens, printer paper, and toner, are tax-deductible. You can also deduct the costs of your internet service provider that are exclusively used for your OnlyFans business and cell phone expenses that are related to your OnlyFans business.

How to Pay My OnlyFans Taxes

As an OnlyFans creator, you are considered a small business owner by the IRS and are required to pay self-employment taxes on your income at a flat rate of 15.3%. To report the money you make, you will need to use “other income” on your 1040 form.

However, if you treat your OnlyFans account like a real business, you can report it on a Schedule C form. According to doola.com, most expenses related to your OnlyFans account can be deducted as business write-offs.

This includes expenses such as pens, printer paper, toner, and your internet service provider. Additionally, a percentage of your cell phone expenses used for your OnlyFans business is tax-deductible.

You can pay your OnlyFans taxes on the IRS website or by mailing in a check or money order.

Step-by-Step Guide to Filing Taxes for OnlyFans

Step 1: Gather Your Income Information

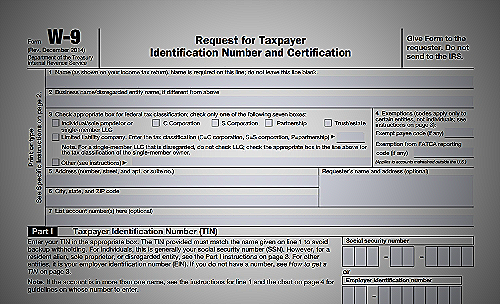

To file your taxes accurately, you must collect your income information, including your earnings from OnlyFans and any other sources of income. According to Doola, the money earned from OnlyFans must be reported as “other income” on your 1040 form.

Step 2: Determine Your Business Expenses

If you treat your OnlyFans account as a business, expenses related to it can be deducted from your tax return. According to Hastings Accounting, the expenses that can be considered write-offs include equipment, internet, and advertising costs.

Keep records of all your business expenses so that you can deduct them accordingly.

Step 3: Choose Your Tax Form

You must choose the appropriate tax form depending on how you treat your OnlyFans account. According to Hastings Accounting, if you treat your OnlyFans account like a real business, you can report your earnings on your Schedule C form.

If not, then you’ll need to file a 1040 form and report your earnings as “other income.”

Step 4: Fill Out Your Tax Form

Once you have determined which tax form you need to file, provide all the necessary income and expense information. Report your OnlyFans earnings under “other income” on your 1040 form, or on your Schedule C form if you are treating it as a business.

According to Doola, the Schedule C form is used to report profit and losses from business activities.

Step 5: Submit Your Tax Forms

After filling out your tax forms, you can submit them through the IRS website or by mail if you are filing a paper return. According to Filing, you must file your tax returns by April 15th each year.

What’s FlyFin?

FlyFin is a tool that can help you automatically track and deduct your OnlyFans business expenses. This means that the tool can assist you in keeping track of all your business expenses on OnlyFans such as pens, printer paper, and internet bills, which can be deducted as business write-offs.

If you need more help with your OnlyFans taxes, FlyFin also offers access to certified public accountants (CPAs) who can assist you with filing your tax return. This will help you when it comes to reporting the money you make as “other income” on your 1040 form.

According to Doola, “You will need to report the money you make as “other income” on your 1040 form. However, if you’re treating your OnlyFans account like a real business, then you can report it on a Schedule C form.”

It is essential to note that being an OnlyFans creator entails that the IRS considers you a small business owner, making it necessary to pay self-employment taxes on your income at a flat rate of 15.3%. The good news is that most of the expenses related to your OnlyFans account can be deducted as business write-offs.

Any expenses incurred in running your OnlyFans page such as pens, printer paper, toner, internet bills are tax-deductible. Consequently, you can deduct the costs of your internet service provider that are mostly used for your OnlyFans business.

Phone expenses can also be tax-deductible, depending on the percentage of use for OnlyFans business.

To sum up, FlyFin is an essential tool for OnlyFans creators to help keep track of business expenses and automate tax deductions, making it easier for them to file taxes. With FlyFin, you also get access to qualified CPAs who can assist you in filing tax returns.

Conclusion

Filing taxes for your only fans income can be a challenge, but with the right information, it can be a little easier. As an only fans creator, you will need to file your income as “other income” on your 1040 form or as a Schedule C form if you treat your only fans account as a real business.

You will also need to pay self-employment taxes on your income at a flat rate of 15.3. The good news is that many expenses related to your only fans account can be deducted as business write-offs.

These include expenses such as internet service provider costs, cell phone expenses used for only fans business, and other costs like pens, papers, and toners.

To file your taxes, first download your 1099-NEC form, which shows how much money you earned from only fans during the tax year. Then, you need to fill out tax forms specific to self-employed people like Schedule C, which reports your business income and expenses.

Finally, you need to figure out if you should pay quarterly estimated taxes. Using tools like fly fin, turbotax, and other tax preparation software can help you file your taxes with ease>

According to

“>Onlyfans Taxes, “you will need to report the money you make as “other income” on your 1040 form. however, if you’re treating your only fans account like a real business, then you can report it on a schedule c form.

References

- How to File Taxes for OnlyFans

- Self-Employed Individuals Tax Center by IRS

- How to File Taxes as a Small Business Owner