How do you pay taxes on OnlyFans? In this article, we’ll guide you through the process of reporting your OnlyFans income and paying taxes on it, ensuring you’re in compliance with the IRS and avoiding any unexpected surprises.

Confused about how to pay taxes on your OnlyFans income? Check out this Youtube video for a comprehensive, easy-to-follow guide on filing taxes for your earnings: “I Make Money From OnlyFans – How Do I File My Taxes?!”

Understanding Your Tax Obligations as an OnlyFans Creator

Income earned through OnlyFans is taxable and should be reported when filing your personal tax return annually. This revenue will be combined with your other taxable income and taxed at your marginal rate.

As an OnlyFans creator, you are considered self-employed, so you are subject to self-employment tax in addition to income tax. To pay taxes on OnlyFans earnings, follow these steps:

- Obtain your 1099-NEC Form from OnlyFans, which shows your total earnings for the tax period.

- Complete the necessary tax forms for self-employed individuals, including Schedule C to report your business earnings and expenses.

- Determine whether you need to make quarterly estimated tax payments based on your expected annual income and tax liabilities.

Organizing Your Finances

When it comes to understanding how do you pay taxes on OnlyFans, organizing your finances is crucial. Start by tracking your income and expenses related to your OnlyFans activities.

Open a separate business bank account to keep your personal and business finances separate, which will make it easier to manage and file taxes.

To pay taxes on OnlyFans income, you need to report this income as “other income” on your 1040 form. However, if your OnlyFans activities are managed like a legitimate business, you should document it on a Schedule C form. Download your 1099-NEC form from your OnlyFans profile and obtain a 1099-K from other payment processors if you earn revenue from content beyond the OnlyFans platform. Then, choose a user-friendly tax software, such as TurboTax, FreeTaxUSA, or H&R Block, and follow the tax submission process within your chosen software.

Filing as a Sole Proprietor or Setting Up a Business Entity

Pros and cons of setting up a business entity

When figuring out how to pay taxes on OnlyFans, you’ll need to decide between filing as a sole proprietor or setting up a business entity. Filing as a sole proprietor has its advantages such as ease of setup, no separate tax return for the business, and potentially lower taxes.

However, it also exposes your personal assets to potential liabilities related to your OnlyFans venture. Setting up a business entity, like an LLC or S-Corporation, offers limited liability protection and potential tax advantages.

These benefits come with added complexity and administrative costs.

Registering your business

Once you’ve chosen between a sole proprietorship or a business entity, you will need to register your business. For sole proprietors, registering may involve obtaining a Doing Business As (DBA) name, applying for an Employer Identification Number (EIN), and acquiring any required licenses or permits.

For business entities, the registration process will vary depending on the chosen structure and state requirements. Typically, it will involve filing articles of incorporation or organization, applying for an EIN, drafting an operating agreement, and obtaining any required licenses and permits.

When determining how to pay taxes on OnlyFans, it is essential to understand your chosen business structure’s tax implications. For example, sole proprietors are required to file Schedule C with their personal tax return, while business entities will have different tax filing requirements. Additionally, self-employment taxes must be paid on your OnlyFans earnings if they exceed a certain threshold.

Deducting Expenses

Record Keeping Best Practices

To pay taxes on OnlyFans earnings, it’s essential to practice accurate record keeping. Keeping track of your earnings, expenses, and tax obligations is crucial for ensuring you comply with tax regulations and avoid any potential issues with the IRS.

Start by maintaining a spreadsheet or using a bookkeeping software to track your monthly income, along with any deductible expenses related to your OnlyFans business. Keep records of all relevant documentation, including invoices, receipts, and tax forms, and aim to update your records regularly to avoid confusion or overlooked information.

Tools for record keeping are widely available, ranging from basic spreadsheets to sophisticated accounting software. Choosing the right tool depends on your preferences and the scale of your OnlyFans business. Examples of popular bookkeeping tools include QuickBooks, Wave, and FreshBooks, which can help you organize and automate your financial tracking. Free tools like Google Sheets or Microsoft Excel can also be effective alternatives, especially for small-scale creators or those new to managing finances.

Filing Your Taxes: The Five Simple Steps

Gather all necessary documents and information

When it comes to how do you pay taxes on OnlyFans, the first step is to gather all the necessary documents and information. You will need your income documentation, such as the Form 1099-MISC, which OnlyFans provides to report your total earnings annually.

In addition to your income documentation, create a list of deductible expenses associated with your OnlyFans activity, such as equipment, software subscriptions, and professional services. Having all of these documents and information handy will make it easier to fill out your tax forms and ensure you’re accurately reporting your OnlyFans earnings.

Choose the appropriate tax forms

To pay taxes on OnlyFans, report your income using the appropriate tax forms. You’ll need to obtain your 1099-NEC from your OnlyFans profile which reports your earnings from the platform. If you have additional sources of revenue from content beyond OnlyFans, you may also need to acquire a 1099-K from other payment processors. Once you have your earnings information, choose user-friendly tax software like TurboTax, FreeTaxUSA, or H&R Block to initiate your tax submission process.

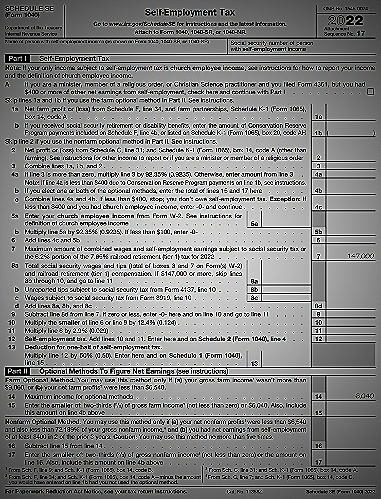

Calculate your self-employment tax

Calculating your self-employment tax for your OnlyFans earnings is an essential step in staying compliant with tax laws. To calculate your tax, you need to use the Schedule SE form with your 1040 Individual Income Tax Return form.

The self-employment tax rate is currently set at 15.3%, which is comprised of 12.4% for Social Security and 2.9% for Medicare. Begin by identifying your total earnings from OnlyFans, then apply the self-employment tax rate to find the amount you owe.

It is crucial to remember to subtract applicable deductions before calculating the final tax amount. Deductions can include expenses related to operating your OnlyFans account, such as equipment costs, software subscriptions, or professional fees. Once you have determined your net self-employment income, you can use the Schedule SE form to calculate your tax liability for your OnlyFans earnings.

Complete and submit your tax return

When it comes to how do you pay taxes on OnlyFans, the first step is to complete and submit your tax return. This process involves downloading the necessary federal and state tax forms, accurately filling them out, and explicitly mentioning your OnlyFans income as part of your self-employment earnings.

Federal and state tax forms

Typically, these forms include the IRS Form 1040, Schedule C or Schedule C-EZ (for self-employment income reporting), and Schedule SE (for self-employment tax calculations). It’s crucial to keep detailed records of your OnlyFans income, expenses, and any other relevant financial data for accurately filing your taxes. In addition, you may need to fill out state-specific tax forms, depending on where you live. Ensure to check with your state’s tax authorities for the right paperwork.

Submitting online or by mail

Once completed, you can submit your tax return either online or by mail. Electronic filing (e-filing) is a quick and convenient option, as it allows you to submit your tax return directly through the IRS website or using authorized third-party software. If you prefer to mail your tax return, you can send it to the appropriate address as listed on the IRS website or your state tax authority’s website. Remember that strictly meeting the annual tax filing deadlines is critical to avoid penalties and fees.Visit the IRS website for more information.

Set up a system for future tax years

When it comes to figuring out how do you pay taxes on OnlyFans, a good system for managing taxes for the following tax years is essential. The first step to consider is estimating your tax payments, if necessary.

Estimating tax payments, if necessary

Start by looking into your OnlyFans earnings and other income sources that may require you to pay estimated taxes quarterly. You can use resources like the IRS guidelines on estimated taxes to better understand the requirements and the process of submitting these payments. Be sure to keep up with deadlines to avoid penalties.

Planning for the next tax year

Planning for the next tax year is crucial for staying on top of your taxes. First, obtain your 1099-NEC from your OnlyFans profile. Additionally, if you generate revenue from content beyond OnlyFans, collect your 1099-K from alternate payment processors. Next, choose user-friendly tax software like TurboTax, FreeTaxUSA, or H&R Block to help with the tax submission process. Keep accurate records of your income, deductions, and expenses to ensure a smooth tax season. By having an organized approach to managing your tax obligations, you’ll always be prepared when it comes to paying taxes on OnlyFans.

Conclusion

In order to pay taxes on OnlyFans, you need to follow several crucial steps: gather all relevant documentation, complete self-employment tax forms, estimate your federal income tax and self-employment tax, make necessary quarterly payments, and submit your tax return punctually using either a paper-based or electronic method. By being diligent with your tax obligations, you can maximize your earnings and avoid any penalties.

References

- IRS Self-Employed Individuals Tax Center

- IRS Form Schedule C Instructions

- IRS Form Schedule SE Instructions