Understanding OnlyFans Taxes

What are 1099s?

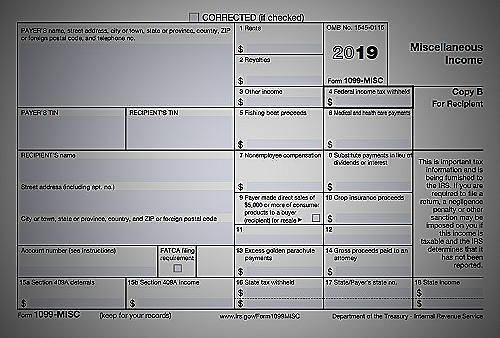

Form 1099 is a series of documents that report various types of income you may receive throughout the year other than “normal” salaries or wages from an employer. Some common types of 1099 forms include 1099-K, 1099-MISC, and 1099-NEC.

Does OnlyFans issue 1099s?

No, OnlyFans does not issue 1099 forms. Instead, the third-party payment processor, which is likely to be either Stripe or Paxum, will issue a 1099-K if you meet certain criteria.

These payment processors are required by the IRS to send a 1099-K if you receive more than $20,000 in gross payments and have at least 200 transactions in the year.

Why is it important to file taxes on OnlyFans earnings?

It is important to file taxes on your OnlyFans earnings because the IRS considers it income and it is taxable. Failing to report your OnlyFans income could result in penalties and fines, and in some cases even legal action.

Check out this Youtube video if you’re an OnlyFans creator who’s unsure about how to get your 1099 form for taxes and learn how to download it hassle-free.

How Do I Get My 1099 from OnlyFans? Step-by-Step Guide

Getting your tax information in order can be stressful but finding your 1099 form on OnlyFans is straightforward. Follow these simple steps:

Check Your Email

The payment processor that OnlyFans uses will send out an email notification when your 1099 form is available to download. Check your email inbox, including your spam folder, for this notification.

Make sure to check the email address associated with your OnlyFans account.

Download Your 1099

When you receive your notification, log into your payment processor’s website using your account information. Follow the prompts to download your 1099 form.

You may be asked to verify your identity or enter the last four digits of your social security number.

Double Check Your Earnings

Compare the information on your 1099 form with the information in your OnlyFans account. Make sure that the amounts match up.

If you notice any discrepancies, contact OnlyFans support for assistance.

File Your Taxes

Use the information on your 1099 form to file your taxes accurately. Remember, OnlyFans will not provide the 1099-K form directly to you.

You will receive it from the payment processor. If you did not receive a form and believe you should have, verify that your address is up to date in your OnlyFans account and log in to download the form.

By following these simple steps, you can easily find and download your 1099 form from OnlyFans. Make sure to file your taxes accurately and on time to avoid any penalties or fees.

What to Do If I Haven’t Received My 1099 from OnlyFans?

If you haven’t received your 1099 from OnlyFans, don’t panic as there are still options available for you to acquire it. Here are some things you can do:

Check Your Spam or Junk Email Folder

Sometimes, the 1099 form could be considered spam by your email provider and could end up in your spam or junk email folder. Check those folders first before contacting support.

Contact the Payment Processor’s Support Team

OnlyFans will not send you the 1099-K, but rather a third-party payment processor will. If you haven’t received your 1099-K or 1099-NEC yet, reach out to the payment processor’s support team for assistance.

Provide them with your tax ID and payment details so they can track down your tax form and send it to you.

Login to Your OnlyFans Account and Download the Tax Form

If you believe you met the requirements to receive a 1099 form but haven’t received it in the mail, log into your OnlyFans account and download the tax form from there. Make sure to verify your address in your account to ensure that the tax form was sent to the correct address.

If you didn’t meet the requirements for a 1099 form but still need to file taxes on your earnings from OnlyFans, download your payment history data and use that as a reference for filing your taxes.

Remember that it’s important to file your taxes accurately and on time to avoid any penalties or legal complications. Contact a tax professional if you have any questions or concerns.

Additional Topics in OnlyFans Taxes in Detail

Self-employment tax: what is it and do I need to pay it?

As an OnlyFans content creator, you are considered self-employed. Therefore, you are responsible for paying self-employment tax on your earnings.

Also known as FICA tax, this includes Social Security and Medicare taxes. You must pay this tax if you earned more than $400 from your OnlyFans account.

The current rate for self-employment tax is 15.3% of your net earnings. This tax will be reported when you file your income tax return.

Estimated quarterly tax payments: how to calculate and pay them

If you expect to owe more than $1,000 in taxes for the year, you may need to make estimated quarterly tax payments. These payments are due four times a year: April 15, June 15, September 15, and January 15 of the following year.

To calculate your estimated tax payments, you can use Form 1040-ES. You will need to estimate your income, deductions, and credits for the year to figure out how much you owe.

Payments can be made by mail, online, or by phone.

OnlyFans tax write-offs: what are they and how to claim them

As a self-employed individual, you are allowed to deduct business-related expenses from your income to reduce your taxable income. Some potential tax write-offs for OnlyFans creators include equipment (such as cameras, lighting equipment, and laptops), internet and phone bills, travel expenses, and home office expenses.

To claim these deductions, you will need to file Schedule C with your income tax return.

Do I need to file taxes on my OnlyFans earnings?

Yes, you are required to report your OnlyFans earnings as income on your tax return. As a self-employed individual, you are responsible for paying self-employment tax on these earnings and filing taxes.

What if I don’t receive a 1099 from OnlyFans?

If you did not receive a 1099 form from OnlyFans, you can check your account to see if it is available for download. If you still cannot access your form, you can request a new one from OnlyFans.

If you are unable to obtain a form, you still must report your earnings to the IRS.

Can I write off expenses related to my OnlyFans account?

Yes, as a self-employed individual, you can write off business-related expenses to reduce your taxable income. Some potential tax write-offs for OnlyFans creators include equipment (such as cameras, lighting equipment, and laptops), internet and phone bills, travel expenses, and home office expenses.

To claim these deductions, you will need to file Schedule C with your income tax return.

How to Get Your 1099 Form from OnlyFans

If you’re a creator on OnlyFans, you’ll need to file taxes on your earnings. To do this, you’ll need your 1099 form, which will be sent to you by OnlyFans’ third-party payment processor.

Here are the steps to obtain your 1099 form:

Check Your Mailbox

If you’re eligible to receive a 1099 form, OnlyFans will send you a physical copy via mail in January. Make sure to check your mailbox to see if you received the form.

If you didn’t receive it, move on to step 2.

Log In to Your OnlyFans Account

If you didn’t receive a 1099 form in the mail and you know you should have received one, log in to your OnlyFans account. OnlyFans could have sent the tax form to the wrong address.

If you met the requirements to receive a 1099-NEC, you can download a digital copy of the form from your account.

References

- Investopedia: How to Get a 1099 From OnlyFans

- One37PM: How Do I File My Taxes for My OnlyFans Earnings?

- Clark.com