How to Get Your 1099 from OnlyFans

First, make sure to update your tax information on only fans. Verify your legal name, residential address, and social security number or tax id number.

only fans will send this information to the payment processor.

Next, keep an eye out for an email from the payment processor. They will send you a notification when your 1099 tax form is ready.

The email will include instructions on how to access and download the form.

Finally, use the information on your 1099 to file your taxes correctly. Include your only fans income on your tax return and report any necessary deductions.

What if You Haven’t Received Your 1099 from OnlyFans?

If you haven’t received your 1099 tax form from only fans by mid-February, reach out to their support team. They can assist you with any issues or provide you with the necessary information to report your earnings on your tax return.

Understanding Tax Form 1099

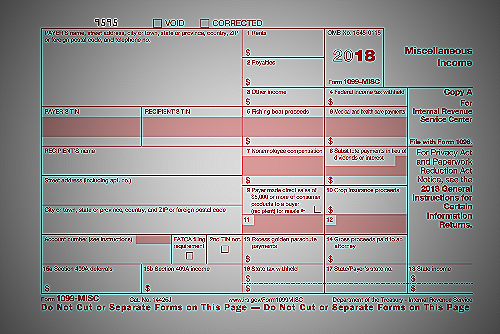

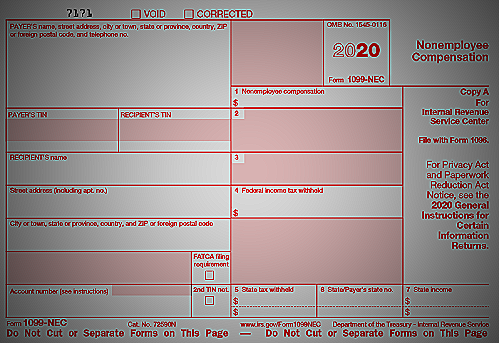

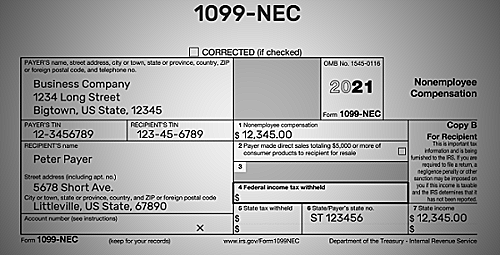

Form 1099 is a series of tax forms used to report various types of income,including income from independent contractors and freelance work. only fans uses either Form 1099-NEC or Form 1099-K to report your earnings.

It’s important to understand the difference between these forms and what information they contain.

Paying Taxes on only fans Income

If you earn money on only fans, you are responsible for paying taxes on that income. Make sure to keep accurate records of your earnings and expenses throughout the year to make filing your taxes easier.

You may also want to consider hiring a tax professional to help you navigate the tax implications of earning money on only fans. They can help you determine what deductions you’re eligible for and ensure that you file your taxes correctly.

Using Social Media to Promote Your OnlyFans

Many only fans users rely on social media to promote their content and attract new subscribers. When using social media to promote your only fans, make sure to comply with their guidelines and terms of service.

Additionally, be cautious about the information you share on social media. Avoid sharing personal identifying information or explicit content.

Instead, use social media strategically to attract potential subscribers while maintaining your privacy and staying within the rules.

Check out this Youtube video to learn how to download your 1099 form for taxes from Onlyfans and stay on top of your finances.

Understanding 1099 Forms

If you receive income from a variety of sources, your taxes can become a little tricky. You need to use the appropriate tax forms and keep track of all your earnings carefully.

With this in mind, one form you need to be familiar with is the 1099 form.

What is a 1099 form?

A 1099 form is a tax form that documents the different types of income you received throughout the year besides your salary. This form is sent to you by the party that paid you, and they also report this information to the IRS.

The 1099 form helps the IRS ensure that you are paying the correct amount of taxes on your income sources.

What is the difference between a 1099-NEC and a 1099-K, and which one will you receive from OnlyFans?

If you are a content creator on platforms like OnlyFans, you may be wondering which type of 1099 form you will receive from the company. The difference between a 1099-NEC and a 1099-K is what type of income is reported:

- A 1099-NEC reports any non-employee compensation and is generally used to report payments made to independent contractors.

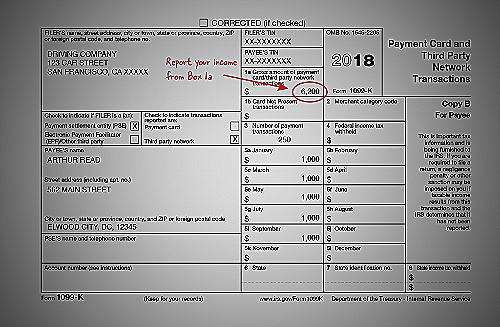

- A 1099-K reports payment card and third-party network transactions, such as payments made on a platform like OnlyFans.

If you make over $600 as a content creator on OnlyFans, you’ll receive a 1099 form. But depending on what State you live in, you may receive a 1099-K instead of a 1099-NEC if you live in Massachusetts or Vermont and have over $600 in gross payments.

OnlyFans will not send you the 1099-K, however, you’ll receive the tax form from the third-party payment processor.

What is the deadline for receiving and submitting your 1099 form?

If you are a U. S. resident and made more than $600 over the year on OnlyFans, you will receive a 1099 NEC from the company. OnlyFans will send you this form by January 31st each year.

It’s important to note that while you receive the form by January 31st, you have extra time before the submission deadline. If you’re filing your taxes yourself, federal tax returns are due on April 15th.

However, keep in mind that tax laws and deadlines can vary from state to state, so double-check your state’s deadlines to ensure you comply with their requirements.

How Do I Get My 1099 from OnlyFans?

Wondering how to get your 1099 form from OnlyFans?

Who Will Send You The 1099 Form?

The 1099 form is not sent directly by OnlyFans. Instead, you will receive it from the third-party payment processor that OnlyFans uses.

They calculate your payouts and send the required tax forms to you at the end of the year.

What Information Do You Need to Provide to the Payment Processor to Receive Your 1099 Form?

You will need to provide some specific information to the payment processor to get your 1099 form. This includes your name, address, social security number or tax identification number, and your payment information.

Make sure to check with the payment processor on what exactly they need to generate your form.

What Do You Do If You Did Not Receive a 1099 Form from OnlyFans, But Earned Over $600?

If you earned over $600 on OnlyFans but did not receive a 1099 form, you should contact the payment processor directly. Make sure that your contact information is correct and that they have everything they need from you to generate the required tax forms.

Also, check with your accountant on how to proceed if you didn’t receive the form after reaching out to the payment processor.

How to Register and File Your Taxes with 1099

If you are an OnlyFans creator and have made over $600 in gross payments over the year, you will receive a 1099 form from a third-party payment processor. Depending on which state you live in, you may receive either a 1099-K or a 1099-NEC.

To register for your taxes, the first step is to make sure you have filled out a W9 form on OnlyFans. This form will have information regarding your name, address, and social security number or taxpayer identification number.

Your digital 1099 form will be available on your OnlyFans account, while the hard copy will be mailed to you in January.

When receiving your 1099 form, make sure to check the accuracy of the information provided, ensuring that it is in line with your gross income for the year. This amount will be your gross business income and must be reported on your income tax return.

OnlyFans creators are considered self-employed and must file a Schedule C and Schedule SE along with their 1040 income tax return. These forms report your business income and also allow for deductions related to your business expenses such as content production, equipment expenses, website fees, and internet costs.

It’s important to stay up-to-date on tax laws and regulations, particularly in relation to your industry. Seek advice from a tax professional if unsure about tax filing requirements or any tax deductions available as an OnlyFans creator.

Best Practices for Tax Compliance on OnlyFans

As an OnlyFans creator, it is important to maintain tax compliance to avoid any penalties and negative impacts on your business. Here are some best practices you can follow:

- Understand your tax obligations – Make sure you know your tax obligations as a OnlyFans creator and familiarize yourself with different tax forms such as the 1099-NEC and 1099-K.

- Keep track of your earnings – It is important to keep track of all your earnings from OnlyFans and other payment providers that you may use outside of the platform.

- Fill out the OnlyFans W9 form – Before you can withdraw your earnings, you must fill out the OnlyFans W9 form.

- Download your 1099 forms – OnlyFans will send you a 1099-NEC in January via mail and a digital version on the platform. You may also have to download a 1099-K from other payment providers. Make sure to download and keep these forms for your records.

- Use a tax software – Use a tax software such as TurboTax, FreeTaxUSA, or H&R Block to make filing your taxes easier.

Not filing your taxes correctly as an OnlyFans creator can result in consequences such as penalties, interest, and even legal action. Make sure to stay informed and follow best practices to maintain tax compliance.

Conclusion

To summarize, getting your 1099 from only fans is a straightforward process. Log into your account, go to your dashboard and click “statements.

Download your 1099-NEC and file your taxes accordingly. Ensure that you also download your 1099-K from your payment provider if you have income outside of only fans.

Remember to fill out the only fans W9 form before withdrawing earnings and file a Schedule C and a Schedule se with your income tax return.

References

- Patriot Software: aba Rule on What Constitutes Tax Advice

- Tax Foundation: 2021 Tax Filing Season

- Funky Income: Does only fans Send a 1099 Form?

- To get your 1099 from only fans, you need to log into your account and download the tax form. only fans will send you a 1099 nec only if you make more than $600 over the year and are a U. S. resident. However, depending on what state you live in, you may receive a 1099-K instead of a 1099-NEC. To withdraw earnings and receive your 1099 form, you will need to fill out the only fans W9 form. Remember to file a Schedule C and a Schedule se with your 1040 income tax return. For more information on taxes and how to file, check out the references provided.