If you’re earning money through OnlyFans, taxes are an important consideration. One common question is whether OnlyFans sends you a 1099 form for tax reporting purposes if you earn money on their platform.

The simple answer is yes, OnlyFans will send you a 1099-NEC form if you have earned more than $600 from the platform for the tax year. However, there are still things you need to know about filing taxes with income from OnlyFans, which we’ll cover in this article.

According to www.hellobonsai.com, if you earned more than $600 from OnlyFans, you will receive a 1099-NEC form for tax reporting purposes. However, even if your earnings are below this threshold, it is still your responsibility to report your income and pay taxes on it in a timely manner.

Failing to do so may result in penalties or legal consequences. It’s important to keep accurate records of your income and expenses related to OnlyFans to ensure you are prepared for tax season.

In this article, we’ll provide more details on how to file taxes with income from OnlyFans.

Check out this Youtube video: “OnlyFans Taxes EXPLAINED!” To learn if onlyfans sends 1099s and how paying taxes on onlyfans income works.

Understanding the 1099-NEC

OnlyFans is required to file a 1099-NEC to U. S. Residents who earn over $600 in a year, according to social-rise.com. This tax form is used to report non-employee compensation and is typically used by freelancers, independent contractors, and self-employed individuals.

If you earn less than $600 on OnlyFans, you won’t receive a 1099, but you are still required to report all earnings to the IRS on your yearly income tax return. It’s important to keep track of your earnings and expenses throughout the year to accurately report them on your taxes.

What if You Don’t Receive a 1099?

It’s important to note that just because you don’t receive a 1099 form from OnlyFans doesn’t mean you don’t need to report your income. According to hellobonsai.com, “If you’ve earned more than $600 through OnlyFans, you can expect to receive a 1099-NEC from them for tax purposes.

In the event that you’ve made less than this amount on the app, odds are that you won’t receive a tax form.”

However, regardless of whether or not you receive a 1099 form, you are still responsible for reporting your income and paying any taxes due before the specified due date. It’s best to keep track of your earnings and consult with a tax professional if you have any questions or concerns about filing your taxes with OnlyFans income.

How to File Taxes with Income from OnlyFans

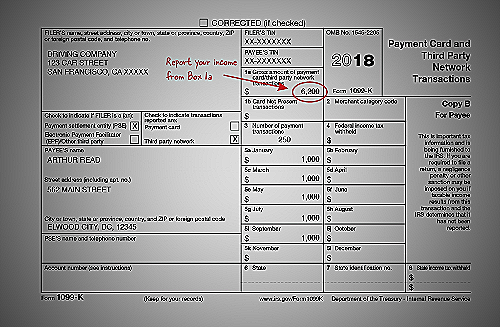

When it comes to filing taxes with income from OnlyFans, it’s important to know that the platform won’t provide you with a 1099-K form. However, you will receive a tax form from the third-party payment processor used for your earnings.

The type of tax form you receive may vary depending on the state you reside in. For example, if you’re a resident of Massachusetts or Vermont and have received over $600 in gross payments, you’ll need to file a 1099-K form instead of a 1099-NEC form.

It’s important to keep accurate records of all your OnlyFans earnings and expenses for tax purposes. You may also want to consider working with a tax professional to ensure you file your taxes correctly and take advantage of all available deductions.

What Deductions Can You Take?

When it comes to paying taxes on your earnings from OnlyFans, it is important to know what deductions you can take to lower your taxable income. Some deductions that may be available to you as an OnlyFans creator include expenses for equipment, internet and phone bills, advertising costs, and home office expenses.

However, it is always best to consult with a tax professional to ensure that you are taking all of the deductions that you are eligible for and to avoid any potential issues with the IRS. Keep in mind that OnlyFans may still send you a 1099 form, even if you take deductions on your taxes.

Other Tax Considerations with OnlyFans Income

According to silvertaxgroup.com, OnlyFans creators who earn more than $600 in one year can expect to receive a 1099 form from the platform. This form should be reported in your tax return as it reports your earnings.

It’s important to note that income from OnlyFans may have other tax implications. As an independent contractor, you may also be subject to self-employment taxes.

Keep track of your expenses related to your OnlyFans business and consult with a tax professional to ensure that you’re filing your taxes correctly.

Frequently Asked Questions

Does OnlyFans send you a 1099?

What if I don't receive a 1099 from OnlyFans?

How do I report my OnlyFans earnings on my tax return?

What deductions can I take with OnlyFans income?

Conclusion

According to only fans, they do not send 1099 forms to their content creators. However, this does not exempt creators from reporting their income and paying taxes on it.

It is important to understand the tax requirements when earning income through only fans and consult with a tax professional if needed.

While only fans does not send 1099 forms, they do provide monthly statements that can be used as a reference for tax purposes. The statements show the earnings and any deductions made during the month, which can be used to calculate the total income for the year.

Creators are responsible for keeping track of their income and expenses related to their only fans content. This includes any equipment or materials used for creating the content, as well as any relevant fees or subscriptions.

Keeping detailed records can help ensure accurate reporting and minimize the risk of errors or penalties.

It is important to note that tax laws and regulations vary by jurisdiction, so creators should consult with a tax professional or research local requirements to ensure compliance. Failure to report income and pay taxes can result in penalties or legal consequences.

In summary, while only fans does not send 1099 forms to their content creators, reporting income and paying taxes is still required. Content creators should keep accurate records of their income and expenses and consult with a tax professional if needed to ensure compliance with tax laws and regulations in their jurisdiction.

References

- OnlyFans Tax Guide: Everything You Need to Know

- How to Report OnlyFans Income

- OnlyFans income taxes: Experts offer advice on what to do