Does OnlyFans send 1099? Yes, OnlyFans will send you a 1099-NEC if you earned more than $600 by using their platform.

However, if you made less than $600 from the app, then you most likely will not receive a tax form. Regardless, you are still responsible for reporting your income earned and paying taxes on it before the due date.

Confused about whether OnlyFans sends a 1099 tax form and how it affects your taxes? Check out this Youtube video to get all the information you need on managing your OnlyFans taxes:

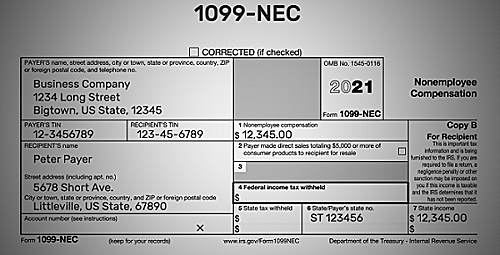

Understanding the 1099-NEC Form and Its Importance

Does OnlyFans send 1099?

Yes, OnlyFans does send 1099-NEC forms to US-based creators who have earned more than $600 in a year on their platform. The form is crucial for content creators as it helps them to determine their total earnings and report their income to the tax authorities.

What is a 1099-NEC form?

A 1099-NEC form is an important tax document provided by businesses to non-employee workers who receive income from their services. It helps the IRS track the income of self-employed individuals, also known as independent contractors, to ensure accurate tax reporting.

Why it is crucial for content creators

For content creators, the 1099-NEC form is essential to maintain financial transparency and fulfill their tax obligations. The form outlines the total amount earned on OnlyFans throughout the year, representing the creators’ gross business income, which is then used to report on their tax returns. By knowing this information, content creators can accurately calculate their taxable income and avoid penalties for under-reporting earnings.

Tax Reporting Tips for OnlyFans Creators

- Keep track of your expenses: Save receipts and maintain records of your business expenses, as this can be helpful in identifying deductions and reducing your taxable income.

- Understand your tax obligations: Familiarize yourself with the tax rules applicable to independent contractors and ensure that you meet the required filing deadlines.

- Set aside money for taxes: Allocate a portion of your OnlyFans earnings for taxes, as you need to pay both income tax and self-employment tax on your earnings.

- Consider seeking professional help: If you’re unsure about your tax situation, consult with an experienced tax professional to ensure that you are staying compliant.

- Report all income generated, even if it’s under $600: Although OnlyFans will issue a 1099-NEC if your earnings surpass $600, it’s still your responsibility to report and pay taxes on any income generated, irrespective of the amount. Referencing hellobonsai.com and social-rise.com.

5 Tax Tips for OnlyFans Content Creators in 2023

Properly Document Your Income and Expenses

When working with platforms like OnlyFans, it’s vital to properly document your income and expenses. Yes, OnlyFans does send a 1099-NEC to both you and the IRS once your earnings exceed $600 through their service. However, if your income falls below $600, you may not receive a tax document, but you still need to report your earnings and pay taxes accordingly. According to hellobonsai.com, it’s your responsibility to declare your income and make tax payments on time, regardless of whether you receive a 1099 or not.

Understanding the importance of keeping detailed financial records can help you stay on top of your tax obligations and avoid potential penalties. This includes tracking all income, expenses, and deductions related to your OnlyFans account.

Documentation such as invoices, receipts, bank statements, and other proof of payments should be kept well-organized and readily accessible.

To stay organized with your financial documents, consider implementing a system that works best for you. This may include using digital tools like budgeting apps, spreadsheets, or cloud storage platforms for easy access to your files.

Regularly updating your records and consistently tracking your earnings and expenses can help simplify the tax filing process and ensure you’re in compliance with tax laws.

Deduct Relevant Business Expenses

It is essential for content creators, like those who use OnlyFans, to accurately deduct related business expenses in order to maximize their tax savings. OnlyFans will send a 1099-NEC tax form if earnings exceed $600 on their platform.

However, it is still your responsibility to report your income and pay taxes even if you earn below that threshold. With that said, knowing which expenses can be deducted is crucial in reducing your taxable income.

Common deductible expenses for content creators

Some common deductions for OnlyFans content creators include equipment costs (such as cameras, lighting, and props), advertising and promotional expenses, website fees, editing software subscriptions, and home office expenses (if applicable). Travel expenses related to your business can also be deductible, such as attending industry events or photoshoots.

Maximizing tax savings

To maximize your tax savings, consider keeping accurate and detailed records of all business-related expenses. Keep receipts and invoices in a dedicated folder or use software to help you stay organized.

Categorize your expenses appropriately, and don’t forget to deduct any relevant expenses that are unique to your business. Also, consult with a professional tax preparer or accountant to ensure you are taking advantage of all eligible deductions and credits to reduce your tax liability.

Pay Quarterly Estimated Taxes

Yes, OnlyFans does send 1099-NEC forms if your earnings surpass $600 on their platform. According to hellobonsai.com, if your income from the app falls below $600, obtaining a tax form becomes less probable. Nevertheless, it is crucial to report and pay taxes on the revenue generated prior to the designated deadline.

Why it’s essential to avoid penalties

Paying quarterly estimated taxes is vital because it helps you avoid potential penalties and interest charges from the IRS. By making regular payments, you can ensure that you are covering your tax liability for the year, keeping you in compliance with the tax laws and avoiding unpleasant surprises when filing your annual tax return.

How to calculate and make estimated tax payments

To calculate your quarterly estimated tax payments, you’ll need to estimate your total taxable income for the year, including all sources such as wages, self-employment, and investments. You can use IRS Form 1040-ES as a guide for calculating your estimated tax payments. Once you have determined your estimated tax liability, divide that amount by four and make payments to the IRS by the due dates of April 15th, June 15th, September 15th, and January 15th. Payments can be made online, by phone, or through the mail. Remember to keep track of your payments and include the information on your annual tax return.

Consult a Tax Professional

Yes, OnlyFans does send a 1099-NEC for creators whose earnings exceed $600 through their platform. Nonetheless, it remains your obligation to report your income and pay taxes based on your earnings, even if you did not receive a 1099-NEC form from OnlyFans. Consulting a tax professional can help you better understand and fulfill your tax obligations.

Working with a tax expert can provide a range of benefits, such as:

- Expert guidance in navigating complex tax issues

- Maximizing deductions and minimizing tax liabilities

- Assistance in tax planning and strategy

- Helping you stay organized and compliant throughout the year

Finding the right professional for your specific needs requires some research and due diligence. Here are some tips to find the best tax professional for you:

- Look for professionals who have experience in the industry and with similar clients

- Read reviews and ask for recommendations from peers or online communities

- Interview potential professionals to gauge their expertise, communication style and fee structure

- Ensure they are up-to-date with the latest tax laws and regulations that may impact your financial situation

Stay Compliant with IRS Rules and Regulations

Does OnlyFans send 1099? Yes, OnlyFans sends a 1099-NEC form to its creators if their earnings surpass $600 on their platform. According to www.hellobonsai.com, even if you generated under $600 through the app, it’s still essential to report your income and fulfill tax obligations before the deadline.

Keeping up with tax law changes is crucial for staying compliant with IRS rules and regulations. As an OnlyFans creator, it’s your responsibility to stay informed about tax laws and updates that may impact your tax filings.

Understanding self-employment taxes and requirements are vital for OnlyFans creators. You must report your earnings for the year, regardless of whether you received a 1099 or not, and pay the required self-employment taxes.

You should also track your expenses, as some may be deductible and could help to reduce your tax liability.

Frequently Asked Questions About OnlyFans and Taxes

Does OnlyFans report your earnings to the IRS?

Yes, OnlyFans does report your earnings to the IRS if your earnings exceed $600 on their platform. A 1099-NEC form will be provided to you by any organization that compensates you with $600 or more for your services during the calendar year, which includes OnlyFans. This document communicates your nonemployee earnings (revenue gained as a self-employed contractor) to you and the Internal Revenue Service (According to www.doola.com).

For those who made under $600, the 1099-NEC tax form might not be provided. Nevertheless, it’s essential to declare that income, even without the presence of a 1099 (According to www.1099cafe.com).

What if I made less than $600 on OnlyFans? Do I still have to report it?

Yes, even if you made less than $600 on OnlyFans, you still have to report it. OnlyFans is required to send you a 1099-NEC form if your earnings exceed $600 in a calendar year. However, if you earn less than that threshold, they might not provide you with the tax document. Regardless of whether you receive a 1099-NEC or not, you are still responsible for disclosing your OnlyFans income on your tax return. Reporting your income accurately is crucial to ensure compliance with IRS regulations.

Can I use a pseudonym for my 1099-NEC and still maintain privacy?

No, you cannot use a pseudonym for your 1099-NEC and still maintain privacy. The form is a legal document issued by companies like OnlyFans to report your income to the IRS. Using a fake name or alias could lead to issues with the IRS and affect your tax compliance. You are required to provide your legal name and accurate information on this form for a proper tax filing process.

But, it’s crucial to maintain the security of your personal information when dealing with online platforms. OnlyFans takes multiple steps to ensure the privacy and security of its content creators’ data.

You can review their privacy policy, follow cybersecurity best practices, and ensure you’re sharing sensitive data only with trusted parties to maximize your privacy.

How can I protect my privacy when filing taxes for OnlyFans?

When it comes to protecting your privacy while filing taxes for OnlyFans, being aware of some key steps can help. Since OnlyFans does send 1099-NEC forms for earnings over $600 within a calendar year, it’s crucial to understand what measures you can take to preserve your privacy. Here are some tips:

- Use a separate email – Create a dedicated email address for OnlyFans-related tax communications.

- Establish a separate financial account – Set up a separate bank account or use a virtual financial service like PayPal to receive your OnlyFans income. This will help you better track your earnings and simplify tax filing.

- Pseudonym – Consider using a pseudonym or stage name for your OnlyFans profile. Make sure to provide your legal name on your 1099-NEC form for accurate tax filings.

- Choose a trustworthy tax preparer – Select a tax professional or CPA who respects and understands the need for privacy when preparing your taxes.

- File electronically – Electronic filing is generally more secure than mailing paper forms. When filing taxes, use e-filing systems from reputable sources such as the IRS Free File program or authorized e-file providers.

In conclusion, although OnlyFans sends 1099-NEC forms for earnings exceeding $600, taking these steps can be instrumental in safeguarding your privacy during the tax filing process.

Conclusion

In conclusion, OnlyFans does send a 1099 form to content creators, allowing them to report their earnings as self-employed individuals. To stay ahead of potential tax liabilities, it’s a good idea for creators to set aside approximately 25% of their annual income for taxes and to keep track of this information using tools like spreadsheets.

Following these tax tips will help ensure compliance with IRS regulations, maximize tax savings, and maintain privacy when reporting OnlyFans income.

References

- IRS Form 1099-NEC Information

- IRS Self-Employed Individuals Tax Center

- OnlyFans Tax Responsibilities and Tips from Hello Bonsai