Are you an OnlyFans creator wondering if the platform reports your earnings to the Internal Revenue Service (IRS)? In this article, we cover everything you need to know about OnlyFans and taxes, including whether or not OnlyFans reports to the IRS.

According to silvertaxgroup.com, OnlyFans creators are responsible for reporting their earnings to the IRS and paying taxes accordingly. While OnlyFans does not report earnings to the IRS directly, the IRS can still find out about the earnings through their tax forms.

It is crucial for creators to keep track of their earnings and report them accurately to avoid any legal implications. It is recommended for creators to consult with a tax professional to ensure they are complying with tax laws and regulations.

In summary, OnlyFans does not report to the IRS directly, but creators are accountable for declaring their earnings and paying taxes on them.

Are you curious about whether OnlyFans reports to the IRS? Check out this YouTube video for expert advice on how to file your taxes as an OnlyFans creator!

What is OnlyFans?

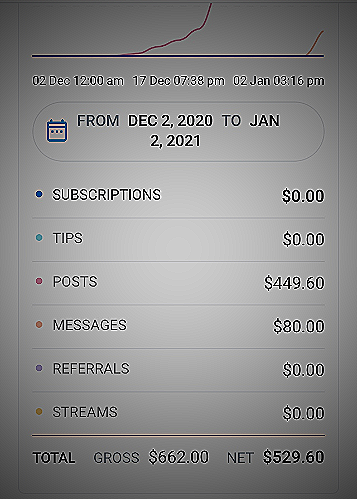

OnlyFans is a social media platform where creators can provide exclusive content to their subscribers for a fee. Creators can earn money through subscriptions, tips, and paid messages, with OnlyFans taking a cut of the earnings.

Does OnlyFans report to the IRS?

Yes, OnlyFans reports income to the IRS for creators who earn $600 or more in a year. According to Doola, if you receive a payment of $600 or more for your work during the year, including your stints on OnlyFans, you can expect a 1099-NEC form from the company you did the work for.

The purpose of this document is to report your income as an independent contractor or nonemployee compensation to you and the Internal Revenue Service (IRS). Therefore, it is crucial to report any income you receive from your work on OnlyFans as an independent contractor.

Does OnlyFans Report to IRS?

Yes, OnlyFans reports earnings to the IRS for creators who make over $600 in a calendar year. The platform issues a 1099 form to these individuals, which must be included in their tax return.

As such, content creators on OnlyFans are obliged to disclose their income to the IRS and remit taxes appropriately based on their earnings.

How to Handle OnlyFans Taxes

As an OnlyFans creator, it’s essential to keep track of your earnings, expenses, and receipts for tax purposes. The IRS classifies OnlyFans content creators as small business owners, which means you’re required to pay self-employment taxes on your earnings at a fixed rate of 15.3%.

However, the good news is that many costs associated with your OnlyFans profile can be deducted as business expenses.

To handle your OnlyFans taxes, you need to keep accurate records of your earnings and expenses. Understand what expenses you can deduct, including equipment, internet, and necessary supplies.

These expenses can significantly reduce the amount you need to pay in taxes.

You can also consider hiring a tax professional to handle your taxes, especially if you are uncertain of your filing requirements or have complex taxes. They can help you maximize your deductions and ensure that you file your tax return on time.

Overall, ensure that you file your tax return on time to avoid penalties. Failure to file or pay your taxes can result in significant penalties, interest, and even legal action.

So, keep your paperwork organized and consult with a tax professional to ensure you are meeting your tax obligations correctly.

FAQs about OnlyFans and Taxes

Q: Do I have to pay taxes on my OnlyFans earnings?

A: Yes, you must pay taxes on your OnlyFans earnings as it is considered taxable income. According to silvertaxgroup.com, any earnings derived from OnlyFans are subject to taxation.

This means that performers are obligated to disclose their income to the IRS and meet their tax obligations by paying taxes on the money earned. It is important to keep track of all your earnings and expenses related to your OnlyFans account to accurately report your income.

Failure to pay taxes on your earnings can result in penalties, interest, and even legal consequences.

While OnlyFans itself does not report earnings to the IRS, it is still your responsibility as the earner to accurately report and pay taxes on your income. It is recommended to consult with a tax professional or accountant to ensure that you are meeting your tax obligations and minimizing your tax liability.

Q: How does OnlyFans tax work?

A: OnlyFans performers are responsible for reporting their earnings to the IRS and paying taxes on their income. All income generated from OnlyFans is subject to taxation.

OnlyFans does not handle taxes for its creators. Therefore, it is important for creators to keep accurate records of their earnings and expenses for tax purposes.

Failure to report income from OnlyFans could result in penalties and legal action from the IRS.

According to silvertaxgroup.com, OnlyFans creators must file their taxes like a small business owner. This means that creators need to fill out a Schedule C form as part of their personal income tax return.

The Schedule C form helps itemize income, deductions, and other expenses related to self-employment. OnlyFans creators can also claim certain deductions related to their work, such as expenses for equipment, internet service, and other business-related expenses.

It is important for OnlyFans creators to consult with a tax professional to ensure they are accurately reporting their income and taking advantage of all possible deductions. By reporting their income and expenses correctly, creators can minimize their tax liability and avoid potential legal issues with the IRS.

Q: How do I file taxes for OnlyFans?

A: According to silvertaxgroup.com, OnlyFans earnings should be included in your tax return as self-employment income. Freelance performers should file their taxes using Schedule C (Form 1040), which provides the IRS with detailed information regarding your business income and expenses.

Seeking professional tax advice before filing your taxes is highly recommended to ensure you are properly reporting your income and avoiding any potential penalties or legal issues.

[important message=’SU1QT1JUQU5UOiBBbHdheXMgbWFrZSBzdXJlIHRvIHJlcG9ydCB5b3VyIE9ubHlGYW5zIGVhcm5pbmdzIHRvIHRoZSBJUlMgYW5kIHBheSBkdWUgdGF4ZXMgdG8gYXZvaWQgc2V2ZXJlIGxlZ2FsIGNvbnNlcXVlbmNlcy4=’ color=’I2RkMzMzMw==’]

Conclusion

Only fans reports earnings to the irs for creators who make over $600 in a calendar year. This means that as an only fans creator, it’s important to keep track of your earnings and report them accurately on your tax returns.

Failing to do so may result in penalties or issues with the irs. Seeking professional tax advice can also help ensure compliance with tax laws and regulations.

According to Forbes, only fans has become a popular platform for content creators, with over 100 million registered users and over 1 million content creators. While only fans does not provide tax advice, they do have support resources available for creators to help them navigate their tax obligations.

It’s important to note that tax laws and regulations can vary by country and jurisdiction, so creators should be aware of their specific tax obligations based on their location. Additionally, only fans creators should keep accurate records of their earnings and expenses to help with tax reporting.

Overall, it’s crucial for only fans creators to understand their tax obligations and stay compliant with tax laws and regulations. Seeking professional tax advice and keeping accurate records can help avoid any penalties or issues with the irs in the future.

References

- NATP OnlyFans Creator’s Guide to Taxes and Reporting Your Income

- IRS Self-Employed Tax Center

- Do I Have to Pay Taxes on OnlyFans Earnings?